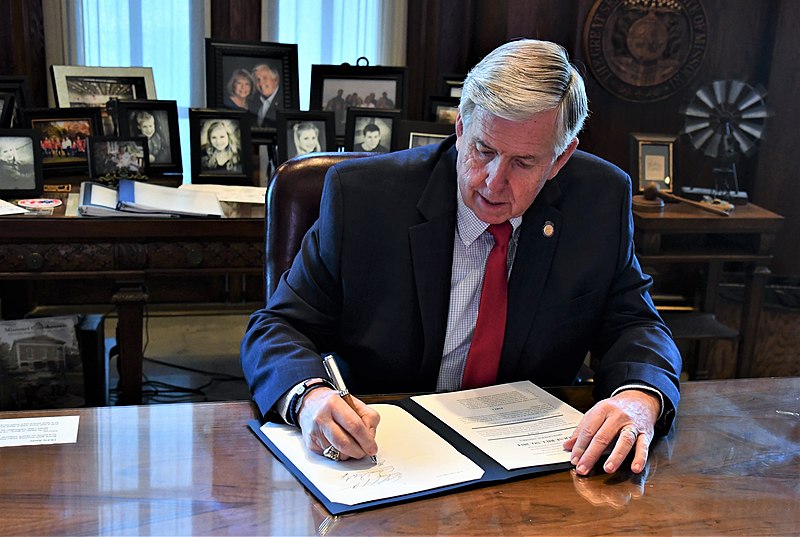

Governor Mike Parson has signed SB 262 into law, which will increase transportation funding for critical state and local infrastructure projects across the state of Missouri. SB 262 provides revenue for Missouri’s roads and bridges by gradually increasing Missouri’s state motor fuel tax by 2.5 cents per year over five years totaling 12.5 cents by 2025.

Missouri has the seventh largest transportation system in the nation but only ranks 45th in available revenue per road mile. Currently, Missouri has the third-lowest gas tax, 17-cents, in the country, behind Alaska and Hawaii. By 2025, the gas tax would be 29.5 cents. The last time Missouri raised its gas tax was in 1996. The measure is expected to generate $400-$500 million in additional annual revenue when fully phased-in. While this funding increase provides nothing for transit providers directly due to Missouri constitutional language, it will impact the roads and bridges the majority of transit providers in MO utilize to deliver service.

An estimated $330 million per year would be available for the State Road Fund administered by the Missouri Department of Transportation (MoDOT), and nearly $125 million – approximately 30 percent of total revenue – would go directly to cities and counties for local transportation projects.

All revenue that SB 262 will generate is constitutionally required to be used to maintain roads, bridges, and the overall transportation system. MoDOT will use these funds to help cover the more than $8.25 billion funding gap for high priority annual transportation needs that have been identified over the next 10 years.

Missourians that do not wish to increase their contributions to state and local roadway repair and replacement projects can submit the required documentation – including fuel receipts – to the Missouri Department of Revenue each year for a refund.